Why is contents insurance necessary for homeowners, landlords, and businesses to protect their important assets? Whether you own a house, rent an apartment, or handle a commercial space under a commercial mortgage, contents insurance confirms that theft, fire, water damage, or accidental loss does not become a financial disaster. In the current economic climate, as residential crime, cyber theft, and climate-related impacts rise across the UK, having the right contents insurance is no longer optional.

What Is Contents Insurance in the UK?

Contents insurance covers the belongings inside your home, including furniture, electronics, personal items, and certain types of flooring, such as carpets. It helps protect your finances if your possessions are damaged, lost, or stolen due to events such as fire, theft, flooding, or accidental damage.

This type of insurance can protect both personal and business property on the premises, depending on your policy.

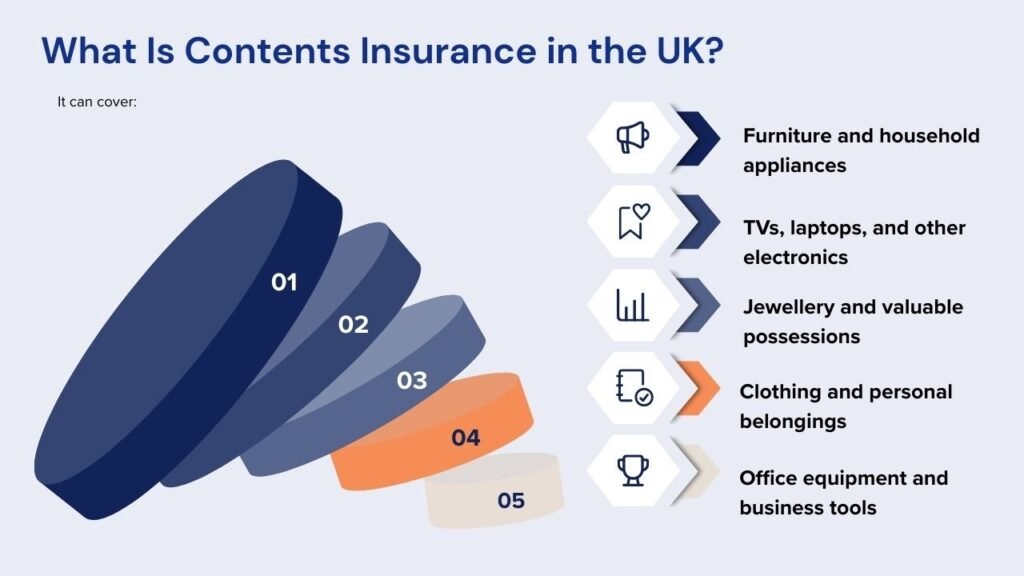

Typically covered items include:

If you can pick it up and take it with you when you move, it is usually covered by contents insurance.

Why Contents Insurance UK Is So Important

Many people feel they do not need contents insurance if they do not own expensive items. But when you add up everything you own, it includes sofas, beds, electronics, kitchen equipment, clothes, tools, and documents. For businesses, the risks are even higher. A single flood, fire, or assault can wipe out equipment, stock, and records containing hundreds of thousands of pounds. Without sufficient contents insurance, recovery can be impractical.

This is why mortgage investors, commercial mortgage providers, and owners strongly recommend or even need contents insurance.

Contents Insurance and Mortgage Insurance

When you take out a mortgage in the UK, lenders require building insurance. However, contents insurance is strongly recommended and often bundled with mortgage insurance policies.

For homeowners:

Your mortgage protects the lender’s interest in the building.

Contents insurance protects your personal assets.

If a fire destroys your home, building insurance restores the property, but without contents insurance, you would have to substitute everything inside with your own money.

This is especially important for people who buy properties with built-in features or invest heavily in interior design, technology, or home offices.

Commercial Mortgage Holders

If you have a commercial mortgage, contents insurance gets even more important.

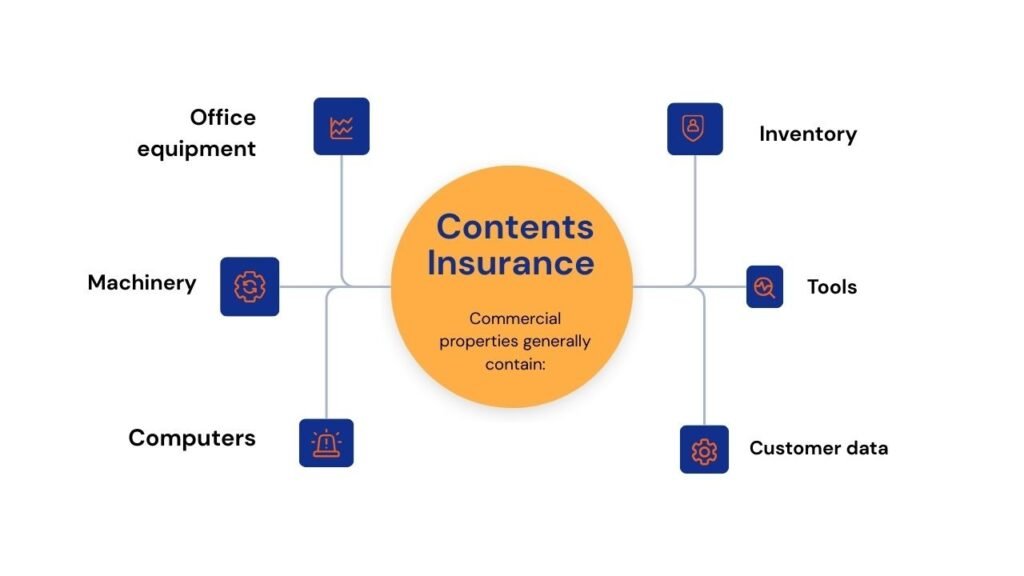

Commercial properties generally contain:

Customer data

While the building may be secured by the mortgage provider, all business contents are your responsibility.

If a fire or theft occurs, your business could be shut down for months. With the right contents insurance policy in the UK, you can rebuild quickly and resume operations without financial loss.

How It Supports Business Stability

For businesses, contents insurance is part of risk management. It works alongside:

- Business disruption insurance

- Public liability insurance

- Employer’s obligation insurance

Together, these policies secure cash flow, assets, and legal danger.

This is where legal guidance for businesses becomes essential. A legal or insurance expert can help ensure your policy content actually handles the dangers your business faces, especially if you manage under a business mortgage or lease.

Legal Advice for Businesses and Insurance Compliance

Many businesses make the mistake of buying minimal insurance without understanding the legal and enforceable risks.

Your rental agreement, commercial mortgage contract, or business agreement may require:

- Certain levels of content cover

- Cover for stock and equipment

- Proof of insurance for landlords or lenders

If you are uninsured, you may be in breach of contract, which could lead to legal action or even mortgage default.

Getting proper legal guidance for businesses ensures your building insurance complies with your contractual and regulatory obligations.

Home Insurance vs Contents Insurance UK

Many people confuse home insurance with contents insurance. In fact, they are different policies.

Home insurance typically involves building insurance.

It covers:

- Walls

- Roof

- Windows

- Floors

- Plumbing and wiring

Most UK insurers offer combined home insurance policies that include both, but it is important to understand what is and what is not included.

If you rent a home, you usually only desire contents insurance, as the landlord is liable for the building.

What Is Not Covered by Contents Insurance?

While contents insurance is universal, it does have limitations.

Common exclusions include:

- Wear and tear

- Technological breakdown

- Innocence

- Unattended valuables

- Business use of home items (unless declared)

If you run a business from home, you must tell your provider. Otherwise, items such as laptops, printers, and business stock may not be accepted.

How to Choose the Right Contents Insurance UK Policy

The best policy is not always the cheapest.

Look for:

- Full replacement is worth covering

- High-value item defence

- Worldwide cover for laptops and phones

- Business equipment cover (if needed)

- Clear demand procedures

For homeowners with a mortgage, ensure your contents policy matches the value of your belongings. For commercial mortgage holders, make sure all business property is included.

For Landlords and Tenants

Landlords:

Usually protect the building and any belongings they provide.

Need contents insurance for items such as stoves, carpets, and furniture.

Tenants:

Need contents insurance for their own property.

Never rely on the landlord’s condition.

This is especially important in shared houses and flats, where theft or accidental damage is more likely.

Why Contents Insurance UK Is a Smart Financial Decision

It is not just about protection; it is about financial reliability.

One crime or fire can cost more than 10 years of insurance payments. When combined with mortgage insurance, home insurance, and business legal counsel, it creates a safety net that protects both your lifestyle and your livelihood.

FAQ

1. What does contents insurance in the UK cover?

It covers personal or business belongings within a property, including furniture, electronics, clothing, tools, stock, and equipment.

2. Is contents insurance required for a mortgage?

Building insurance is essential for a mortgage, but contents coverage is highly recommended to protect everything within the property.

3. Do I need contents insurance with a commercial mortgage?

Yes. A commercial mortgage covers the building, but you must cover all business equipment, stock, and assets individually.

4. Is contents insurance part of home insurance?

It can be. Many providers offer combined home insurance that includes both building and contents cover.

5. Why should businesses get legal advice for insurance?

Legal advice for businesses ensures your contents insurance meets contract, lease, and lender requirements, preventing disputes and financial risks.